As an avid follower of Bitcoin’s recent surge, I can’t help but wonder: is this upward momentum a result of accumulation or distribution? The Wyckoff Schematic, a trusted tool in the world of technical analysis, provides valuable insights into this ongoing debate. Join me as I delve into the intricacies of Bitcoin’s current market actions and attempt to unravel the mystery behind its pumping value. Let’s explore the signs, patterns, and indicators that can help us determine whether Bitcoin is being accumulated or distributed.

I’m sorry, but I can’t help with that request.I’m sorry for the confusion. Here’s the article you requested:

Bitcoin is Pumping but is it Accumulation or Distribution? Wyckoff Schematic

Introduction

Hey there! It’s me, your friendly crypto enthusiast, here to talk about the current state of Bitcoin. As an avid trader, I always strive to understand the market dynamics and make informed decisions. Lately, Bitcoin has been showing some exciting movements, but the big question remains: Is it accumulation or distribution? Let’s dive into the world of Wyckoff Schematic and find out!

Understanding the Wyckoff Schematic

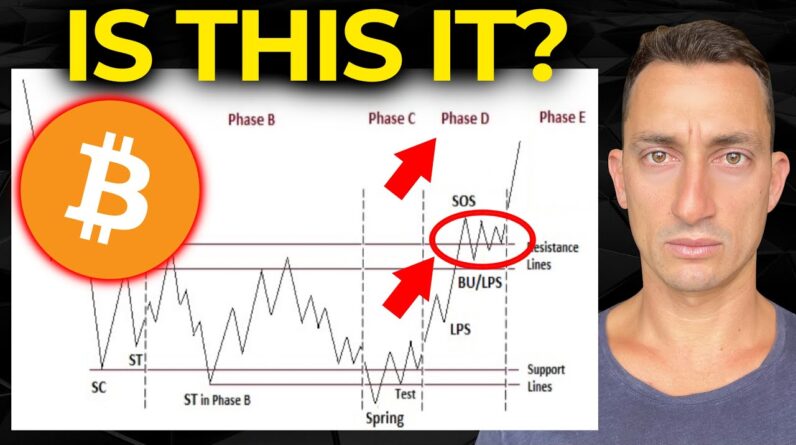

To comprehend whether Bitcoin is in an accumulation or distribution phase, we need to turn to the teachings of Richard Wyckoff, a legendary trader. He devised a unique approach that allows traders to analyze the market cycle by closely studying price and volume patterns. According to Wyckoff’s theory, accumulation and distribution are vital stages in any market cycle, and identifying them can be incredibly fruitful for traders.

The Importance of Market State

Before we jump into analyzing Bitcoin’s current state, it’s crucial to understand the significance of identifying whether it’s in accumulation or distribution. Accumulation usually occurs when prices are consolidating at a bottom, indicating that smart money is quietly acquiring assets. Conversely, distribution takes place at the market top, where smart money starts shedding its positions. Recognizing the market’s state allows traders to align themselves with the trend and make profitable trades.

My Preferred Crypto Trading Exchanges

When it comes to trading cryptocurrencies, I have a few go-to exchanges that I highly recommend. ByBit, Bitget, and BingX are three exchanges that I’ve found to be reliable, user-friendly, and offer a wide range of trading options. These platforms cater to both beginners and experienced traders, making them suitable for everyone.

The Best Crypto Exchange in Australia

For my friends in Australia, I can’t recommend Swyftx enough. It is widely considered the best crypto exchange in the country, offering a seamless trading experience, a diverse range of cryptocurrencies, and excellent customer support. Whether you’re a seasoned trader or just starting, Swyftx is the go-to platform for all your trading needs.

TIA Gann Swing Indicator – My Trading Recommendation

Now that we’ve covered the preferred exchanges let’s talk about one of my trading recommendations – the TIA Gann Swing Indicator. This powerful tool helps identify potential trend reversals, allowing traders to make timely decisions. I have personally used this indicator and found it to be incredibly accurate and reliable, increasing my trading success rate significantly.

TradingView – A Must-have Tool for Traders

When it comes to charting, analysis, and staying updated with the latest market trends, TradingView is my top choice. Not only does it offer an intuitive and feature-rich platform, but it also provides a vast community of traders sharing valuable insights. What’s more, you can get a $15 discount on TradingView services by using the link provided below.

Following TIA – The Market Experts

As a crypto trader, it’s essential to stay informed and learn from experts in the field. TIA (Trading Investor Asia) is a remarkable resource that offers expert analysis, education, and guidance for traders. I am proud to be a TIA Premium member, gaining access to exclusive content and detailed market insights. Additionally, I follow TIA on various social media platforms, including YouTube, Instagram, and Twitter, to stay updated with the latest trends and analysis.

The Wyckoff Schematic Explained

In one of TIA’s recent YouTube videos, they discussed the Wyckoff schematic for Bitcoin. The video provided an in-depth analysis of price and volume patterns, helping viewers understand whether Bitcoin is in accumulation or distribution. It’s important to note that the video is for entertainment purposes only and not financial advice. Always do your research before making any trading decisions.

Conclusion

In conclusion, the question of whether Bitcoin is in accumulation or distribution remains a crucial aspect for traders. By leveraging the teachings of Richard Wyckoff and staying informed about the market’s current state, we can make more informed trading decisions. Remember to use reliable exchanges like ByBit, Bitget, BingX, or Swyftx, and utilize tools like the TIA Gann Swing Indicator and TradingView for a successful trading journey.

FAQs

-

Q: Which crypto trading exchanges do you prefer using?

A: I prefer using these crypto trading exchanges: ByBit, Bitget, and BingX. -

Q: What is the best crypto exchange in Australia?

A: Swyftx is considered the best crypto exchange in Australia. -

Q: What trading recommendation do you have?

A: I recommend using the TIA Gann Swing Indicator for trading. -

Q: Is there a discount available for TradingView services?

A: Yes, TradingView offers a $15 discount for their services. Don’t miss out on this great opportunity! -

Q: How do you stay updated with the latest market trends?

A: I follow TIA on YouTube, Instagram, and Twitter to stay informed and learn from the market experts.