I, as an experienced investor, am excited to share with you my insights on the current market trend in this blog post. The intersection of Bitcoin and the SP500 MAJOR BOTTOM Signal has caught my attention, and I believe it hints at an ideal opportunity for investors in the upcoming fourth quarter. Allow me to delve into the details and shed light on how investor fear plays a crucial role in setting the perfect stage for profitable ventures. Join me as we explore the exciting possibilities that lie ahead.

Introduction

Hey there, folks! I hope you’re all doing fantastic. Today, I want to share some exciting insights into the world of Bitcoin and the stock market. In this article, I’ll be reviewing a video by the renowned Jason Pizzino. So, grab a cup of coffee and get ready to dive into the fascinating world of cryptocurrency trading and market analysis!

Bitcoin, SP500 MAJOR BOTTOM Signal: Investor Fear is Setting Up the Perfect Q4

In his latest video, Jason Pizzino discusses the critical price level of $28,400 that Bitcoin recently got rejected at. This rejection has potentially changed the macro bull market structure and has captivated the attention of investors worldwide. But hey, let me share my perspective on this matter.

Bitcoin Market Analysis

-

The Rejection at $28,400:

Bitcoin’s recent rejection at the crucial price level of $28,400 has raised concerns among investors. Many are speculating about the impact this rejection might have on the market. As a crypto enthusiast, I’ve been closely following the developments, and I must say, it’s an interesting time in the crypto space.

-

Choosing the Right Crypto Trading Exchanges:

When it comes to trading cryptocurrencies, I prefer using the following exchanges:

- ByBit: I love ByBit because it offers a free $30,030 bonus and 0% maker fees. It’s a fantastic platform with a user-friendly interface.

- Bitget: Another excellent choice is Bitget, which offers a free $8,725 bonus. It provides a seamless trading experience.

- OKX: For a hassle-free trading experience, I suggest OKX. They offer bonuses with 0% maker and taker fees.

- Swyftx: If you’re in Australia, look no further than Swyftx. It’s the top Bitcoin and crypto exchange in the country, and you can enjoy a $20 free BTC bonus.

-

The TIA Gann Swing Indicator:

To enhance your trading experience, I highly recommend using the TIA Gann Swing Indicator. It’s a reliable tool that can help you make informed trading decisions. Trust me, this indicator has been a game-changer for many traders out there.

-

Market Volatility and TradingView:

When it comes to chart analysis, TradingView is my go-to platform. It offers a wide range of tools and indicators for technical analysis. And the best part? You can get a $15 discount on TradingView, which makes it even more appealing.

The Stock Market Scenario

-

The S&P 500’s Recent Drop:

It’s crucial to keep an eye on the stock market, too. In the last 24 hours, the S&P 500 has dropped by 1.37%. This decline has left investors uncertain about the future direction of the market.

-

Historical Trends and Market Projection:

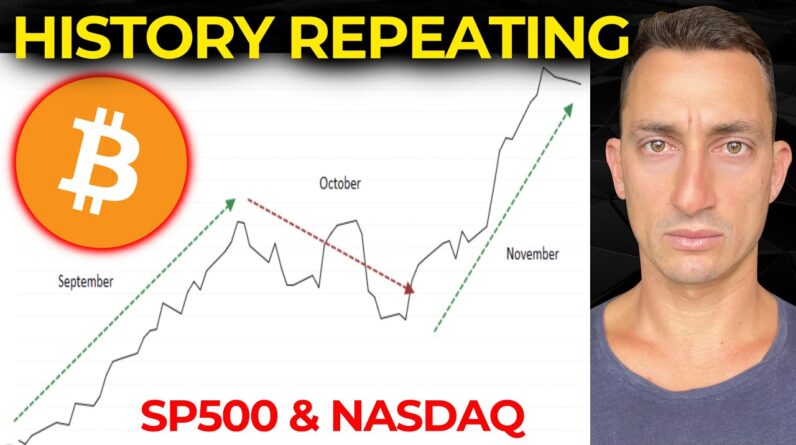

Based on historical data, when the volatility index falls below 14 in August, the S&P tends to rally in September, consolidate in October, and rally again in November. This pattern suggests that we might enter a trading range until the end of October before witnessing a climb in the second half of quarter 4.

-

The Dollar’s Influence:

It’s worth noting that the dollar’s recent climb has started losing momentum. This situation could potentially provide relief for the stock markets. The relationship between the dollar and the stock market is complex, but this shift in momentum might be a positive sign for investors.

Conclusion

To sum it up, we are currently experiencing an intriguing period in the world of Bitcoin and the stock market. The rejection of Bitcoin at $28,400 has created uncertainty among investors, while the S&P 500’s recent drop has added another layer of complexity. However, historical trends and market projections hint at the potential for a favorable Q4. Remember, staying informed and making calculated decisions is key in this ever-changing market.

So, stay tuned, stay updated, and embrace the exciting journey ahead!

FAQs

1. Where can I find Jason Pizzino?

You can find Jason Pizzino on YouTube, Twitter, and Instagram. Follow him for more insightful content and trading tips!

2. What are the recommended crypto trading exchanges?

Some of the recommended crypto trading exchanges are ByBit, Bitget, OKX, and Swyftx. Each of these platforms offers unique features and bonuses for traders.

3. What is the TIA Gann Swing Indicator?

The TIA Gann Swing Indicator is a powerful tool that assists traders in making informed decisions. It can be used to analyze market trends and identify potential entry and exit points.

4. How can I get a discount on TradingView?

You can take advantage of a $15 discount on TradingView for chart analysis. Keep an eye out for promotions and offers on their website.

5. What can we expect from the market in Q4?

Based on historical trends, the market may enter a trading range until the end of October, followed by a climb in the second half of quarter 4. Keep a close watch on the market developments to make the most of the opportunities that arise.