🏆 (DROPPING IN 24 HOURS!) Free Crypto & Economic Report Emailed To You:

🔥 TIA Premium! Trading Courses & Exclusive Community

****************************************************************

LIMITED TIME – 16th May 2023 – FREE $230 USDT with ByBit & Bitget (No Trading Required):

🟠 Bitget Free $8,725 (US + Global Users NO-KYC)

▶ New Users: KYC & Deposit $100 or more to get 10% Cashback (up to $200 cashback in USDT)

🟠 ByBit Free $30,030 + 0% Maker Fees

▶ New Users: KYC & Deposit $100 or more to get $30 USDT bonus plus 0% maker fees for the first 30 days.

****************************************************************

UP TO $38,755 FREE! Crypto Exchanges

🥇 ByBit Free $30,030 + 0% Maker Fees:

🥈 Bitget Free $8,725 (US + Global Users NO-KYC)

🇦🇺 Swyftx, Best Australian Crypto Exchange, Limited Time $20 Free BTC

▶ My Official Socials ◀

YouTube

Instagram

Twitter

▶ My Must-Have Crypto Resources ◀

👾 Free TIA Community Discord:

📈 TIA Gann Swing Indicator

🏆 TIA PREMIUM MEMBERS, Trading Courses & Exclusive Community

🐂 TRADINGVIEW ($30 Off)

🔐 LEDGER (Limted Time $30 Free BTC)

👨🏫 KOINLY (20% Off)

This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. #crypto #bitcoin #cryptonews

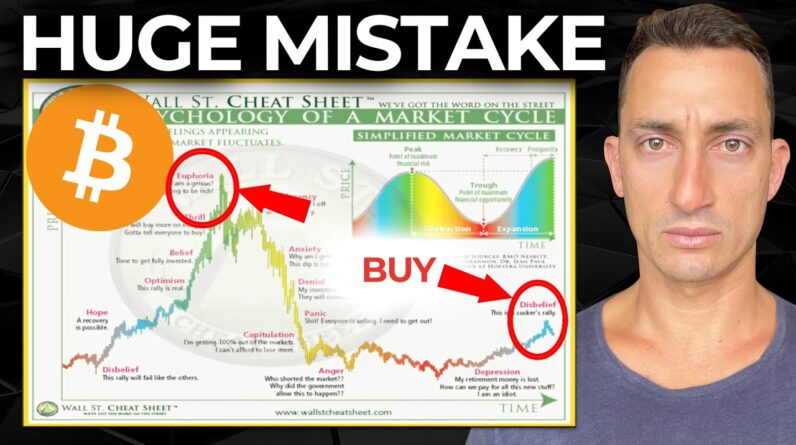

There's a huge battle going on in the Markets between the Bears and the Bulls Over the last 10 days Bitcoin has Dropped 13 from those highs of 31 000 Down to 27 000 dropping it all the way Back into the danger zone and so is this The time now that the Bears finally take Control and dump the market past 19 and A half thousand and fifteen and a half Thousand those significant lows in the Transitional period from a bear to a Bull market let's uncover that in Today's video and also what's going on In the s p as it continues to hover Around some critical support levels guys Make sure you have subscribed hitting That like button at the same time making Those fireworks go off there down below And we have 24 hours until our free Crypto and economic report comes out so Click that link top of the video Description it is your home of macro Cycle analysis you don't get this Anywhere else on the internet as we Bring together the real estate cycle Stock markets Commodities and of course The big old money maker Bitcoin and Cryptocurrencies Now I want to start with a couple of These video titles that we looked at About two weeks ago now main thing here Is as we started to reach the peaks of BTC we saw a lot of bears flipping Bullish now this is probably just the

Influencer type Bears who are always Bearish when the times are good for them To be bearish and then always bullish When everyone else is bullish and so I Was looking at this as being a major Mistake at those levels we saw it in the Fear and greed we saw it in the Confidence levels and of course in the Price and the structure as well Michael My brother you can find his Twitter and Instagram post and YouTube Sorry posted A really good post here on Twitter Showing that there are a lot of by the Dips when these things come in it's Usually a sign of maybe an intermediate Top or maybe the major top if we were at The end of the Bitcoin cycle and so I Only got all of this sort of garbage Here from any of these sorts of accounts Buy the dip by the by the dev on the way Down here especially after the Market's Already gone up 100 that's because That's what the retail want to hear to Make themselves feel good about those Buyers and when we pointed that out Specifically here in this video here big Mistakes because once you see those Bears start to flip Bulls it's almost Like we've got everyone shifting into That one stage of thought this is for The short term For the longer term I still remain macro Bullish because like we saw many times Before at these lows in the market

Banking crisis low you had everyone Flipping bearish There Was 80 90 percent Nearly everyone flipping bearish at These points and these are the worst Times to be flipping bearish remember The banking crisis of five weeks ago now Markets are up from that point and Especially Bitcoin is a long way from Those levels so looking at the short Term before we get into the longer term Stuff yes there is still further room to The downside we haven't seen the market Fall to any sort of significant support Just yet for now it's holding it around Twenty seven thousand dollars to the Downside we've got 26 and a half and Like we've pointed out in previous Videos there is the possibility of Coming back testing some of these Previous highs you've got these swing Bottom levels here at around 24 or 23.9 But more importantly let's have a look To see how it responds to twenty five Thousand three hundred dollars which is The big old 50 between the bottom and The top these were the levels at these Lows 19 and a half when the banking Collapse is going on svb going down Silvergate going down Credit Suisse Deutsche Bank they were the levels that Everyone was freaking out about even the Best of analysts talking about how much More the market had to collapse and from That point we springboarded from 19 and

A half up to 31. so a solid 50 move in That time when everyone else was bearish Of course we were here being bullish you Guys understand why that was the case So let's have a look at the disbelief And how things are shaping up at the Moment all right so S P 500 we are still Hovering around these higher levels at The moment this is potentially in some Sort of disbelief for a lot of investors Who have some time or another thought That the market was going to collapse Each time we get to these lower levels You can see the confidence drop and People expect a lot lower price to come Into the market we saw it in the October Low we saw in the December low we sort Of in the March low but we just keep Holding up and going higher from this Point the vix on the other hand is also Dropping to lower levels even though There's been many calls for this to be The support level for the vix basically Every time it's come back to these Levels many people have expected the vix Just to rise and put in a new low for The s p but so far all that's happened With the vix is it had a small small Bounce and has now dropped back under 17 And so we've noted many times in the Past that when we do get under this 17 Level it can be the start of a new bull Market that doesn't mean we're going to Shoot straight up to new highs it

Doesn't mean we're going to have to Break out of the tops on the S P yes There is the there is room for the vix To come back a little bit and then give Some back to the s p meaning the little Drop in the s p but for now it looks Like we're at least holding these levels And not bouncing all the way back to the Previous resistance Zone which has in The past meant lows for their s p you Can see that's here in May and June and Then again in the October lows and then Most recently in the March 2023 lows the Confidence of the market also has some Confused and I've managed to find a bit Of a pattern here which seems quite Strange but nonetheless let's take a Look at it you can see the lows For the S P 500 which is this black line Up here there's some significant lows And if you weren't in the market it's Hard to explain how significant some of These smaller lows were you have to Remember that this was covered crash This was the pandemic that everyone Around the world expected the market to Collapse from that point yes from this Time we've had a whole lot of money Printing going on but nonetheless let's Just take a look at these significant Lows through the market and this is During the early stage of the v-shape Recovery on the S P 500 so in terms of The confidence here we have the smart

Money dumb money confidence the levels Above this dotted line that's getting Overconfident and under here is you're Just losing the confidence so basically Getting pessimistic about the market the Brown Line Is the dumb money and the blue lines are The smart money but something crazy in The early stages of these markets uh you Can see the dumb money getting quite Confident on the move out of the bottom Yet the smart money is not very Confident in the move out of the bottom Yeah at the tops the dumb money is Starting to come back down and the smart Money is getting a little more confident But they're getting confident at the Lows in the market and you can see this Happen throughout the bear market so It's almost as if the smart money is Feels safer and more confident to buy at Lowe's whereas the dumb money likes to Buy at tops which is what is represented On these particular levels here however They're more excited to buy at the tops Earlier on in the move At least just going back the last three Years so again here's the brown here is The top that happened in around February And now we're at a similar top here in March and April and so they're getting More confident than the smart money Smart money is buying up or is getting Less confident at the highest but

They're buying at the lows so you can See the smart money here and they're Buying at the lows whereas the dumb Money is buying at the tops but The price itself is not that different At the beginning of this particular move Whereas in this case This dumb money has been buying at the Peaks but the market continued up from That point it happened again through This area you can see that the smart Money is down here and the dumb money is Up here buying through this move to the Top But at the extreme moves themselves You've got the dumb money being very Fearful at the low and the smart money Being very confident at the low so That's something to take into Consideration when we assess the smart Money dumb money confidence here Something quite interesting I found Especially coming out of any of those Major moves to the downside so some big Quick Corrections or longer Corrections Here like we saw over 2022 so that leads Us to the market sentiment around Bitcoin this is something that I posted On Twitter going back now nearly four Weeks 30th of March Bitcoin crypto Wall Street cheat sheet and it's really Interesting to see a lot of comments Where people are saying that there's Still a looming recession this has been

Going on now for 14 15 16 months there Is talk of recession came in early 2022 And you could probably look back into 2021 as well and of course we had that Very quick recession in 2020 so it's Basically been in the backs of people's Minds for the last three three plus Years and it just surprises me how much It continues to keep up in the chart There is always something looming out There this as I said was about four Weeks ago so the market has pushed up Higher from this point so potentially we Are in this disbelief stage this is a Suckers Valley because we still have a Lot of bears in the market and so the Uncertainty between the Bulls and the Bears can lead to that disbelief it's Like how is this possible that the Market is now pushing out of a Significant low a hundred percent from That low and it is not so far coming Back to break any of the other Significant lows in the market how is This even possible there's the disbelief And we have come from a place of anger After we had all the collapses of C5 Celsius Voyager block fire you name it Was out there then we had the FTX so There's the depression the retirement Money's lost everyone's money was lost From that point and eventually we Eventually we move into a disbelief Stage of the market and it's disbelief

Because you just can't believe that it's Happening so according to our Wall Street cheat sheet yes there are a few Different ways that people are looking At this and some are even saying that We're only in anger and we're bouncing Out of here and dropping I will say that This is the setup trap that I think is Potentially happening for cryptocurrency Not Bitcoin so for the altcoins rather Than for Bitcoin and I'll show you that In the charts in just a moment because We have uh also covered that on the Channel as we went through clear some of These off we went through the disbelief And then recently we looked at altcoin Wyckoff analysis where Bitcoin looks Like it's obviously leading the charge That's typical and we just get those Small altcoin pumps however the old Coins haven't given any confirmation That they are out of this Zone here as Like you can see in the thumbnail that I've posted here the sign of strength But going back to BTC I don't know if We're in this hope recovery possible yet We're definitely not there because there Are far too many bears around and you Can see that from a lot of comments say It goes through the YouTube comments or You go through Twitter comments there Are a lot of them here especially when They start to say how stupid you are or Something like that that's a very

Typical sign of this disbelief the Suckers rally there so Just going back to this chart itself uh Disbelief this rally will fail like Others that is probably the period that We are currently in right now for the Disbelief especially if this takes the Next couple of months to play out for BTC so where did I get that couple of Months from well we can look to the Previous Cycles we had four months going Back in 2018 2019 there's another two Four six seven or so months where the Market basically fell after it pumped And then we had another one two three Four five six months during this move Out of the pandemic low so it had to Bounce back into the the trading range Itself before it was able to break out And then go on that Mega Run so we're Basically only in our first box of Accumulation and of course some may Still say that this is distribution Because they expect the market to fall Further it's this Market isn't showing Signs of that at least for now all right So I'm still very much in the macro Bear Camp short term yes we do need to come Back and re-test some levels because That is what has happened many times in The past so where can we currently see Ourselves and and how long could that be Well if we look back at these last Accumulation zones as the market was

Breaking out of the previous Accumulation so basically Re-accumulation take one of these little Boxes and like we're looking forward Maybe it's a couple of months maybe it's Around that four to six months like it Has done pretty much every other time in The past so you have the accumulation Six to seven eight months in the past Then the market is broken out and then Hovered in this Zone it didn't really go Below the first month of the breakout so You have this month and then this month Here so the October 15 and November 15 And then it just remained in this Sideways period before it broke out Again in this case it came back down Tested the low and then closed higher so There's always that opportunity or that Possibility as well sideways for another Couple of months as it started to climb Within the zone and then broke out of The zone so where does this take us from Now we've got March we're into April Maybe we go to the end of this it's Somewhere after summer maybe there is This period of Summer that's a little More quiet and the market doesn't have As big of a move like it did out of the Lows in November December where it moved That 100 as for a range potentially the Top is around 31 000 for the downside We've looked at those support levels and We go into the shorter term time frames

Here 26 and a half down to 25 25 3 and Then we have those swing bottoms here at Around 23.9 to 24 000. I wouldn't expect the market to Hold out too long underneath these Levels so basically that lower price Here and expect it to at least touch and Test some of these levels if it was on The weaker side and we're potentially on That weaker side because the fear and Greed is uh is also at higher levels Typically it needs to get back down into At least the fear zone or the high end Of the fear just like it did during the Anching crisis where it reached 34 33 Maybe it touches into the high 20s so Far we're not there yet so maybe we have To hold out come back for a Pity rally And then drop but we want to see the Fear drop back down to these levels Doesn't mean the price drops back down To those levels it's just the fear so Any sort of move to the downside should Cause the fear and greed in the market To drop back down and as it drops back Down it's a perfect time to reset the Market sentiment it's to reset the Market confidence that's what we need we Need a reset on people's feelings and Emotions otherwise we end up with all These sorts of influences across Twitter And YouTube telling everyone to buy the Dip after the Market's already 100 up Absolute nonsense which leads me over to

All coins we looked at this in that Video as I put it out here about five Six days ago This I'm not confident on being the Final accumulation like Bitcoin because It hasn't broken out the main thing it Hasn't done is give us a sign of Strength that breakout to the upside Here like it has done in the past and This typically happens towards the end Of the accumulation range for all coins What we may be in for all coins right Now Is possibly this particular move here That's possibly what we have just seen So all the other stuff that I'd drawn on Here from that previous video as you can See right there this would have to get Moved over so these phase a b c this Would then get moved over and that's Exactly what we talked about in this Video here there's no confirmation yet So we have to wait and see when the sign Of strength confirms the market breaking Out that is your key signal that this Was an accumulation range so until then We're on the cautious side for all coins As yes there are some great trading Ranges as for trading that is what we Specifically go through in our Tia Premium memberships trading courses and We have an exclusive Community this Price is going up in the near future so If you want to jump on board I would

Suggest having a look at that now and Claiming your cheaper membership so Check that out link is in the top of the Video description so this is where we Currently set for all coins and Potentially should these lows not hold Then we have to come back and test the Lower prices here at around 320 billion dollars for the altcoin Market so that would mean that we've Gone through this particular run and We're in the midst of this current run Here if we get this break to the Downside so we've got a few more months Left there for the old coins yes there's Going to be some more opportunities for Trading you all you want to see is the Volatility and some good trading ranges But for the longer term holds it needs That breakout for the confirmation that The accumulation range is over and we Head back into one of these Mega altcoin Seasons or multiple altcoin Seasons like We saw in late 2020 early 2021 and then Again in more later 2021 it's been a Bearish start to the week but don't go Anywhere we've got plenty of Announcements coming up with GDP and Earning seasons in the US like And Subscribe to the channel links in the Top of the video description for our Free crypto and economic report coming Out this week you won't find this info Anywhere else on the Internet it's where

Your home of macro cycle analysis The Tia premium is going up in price Check that out if you want to get on Board and you've been waiting to see What happens next now is your time I'll See you guys at the next video Until Then peace out