💵 Register NOW For Our FREE Trading Workshops + Free Crypto & Economic Report :

🔥 TIA PREMIUM MEMBERSHIP: Trading Courses & Exclusive Community

Please subscribe and share the content with a friend if you find it valuable to you. Thanks, Jason.

UP TO $38,745 FREE! Crypto Exchanges

🥇 ByBit Free $30,030 + 0% Maker Fees:

🥈 Bitget Free $8,725 (US + Global Users NO-KYC)

🇦🇺 Swyftx, Best Australian Crypto Exchange, $20 Free BTC

(Disclaimer: Swyftx, ByBit and Bitget are channel sponsors. All decisions you make are your own.)

▶ My Official Socials ◀

YouTube

Instagram

Twitter

▶ My Must-Have Crypto Resources ◀

👾 Free TIA Community Discord:

📈 TIA Gann Swing Indicator

🏆 TIA PREMIUM MEMBERSHIP, Trading Courses & Exclusive Community

🐂 TRADINGVIEW ($15 Off)

🔐 LEDGER Crypto Wallet

👨🏫 KOINLY Crypto Tax (30% Off)

This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. #crypto #bitcoin #cryptonews

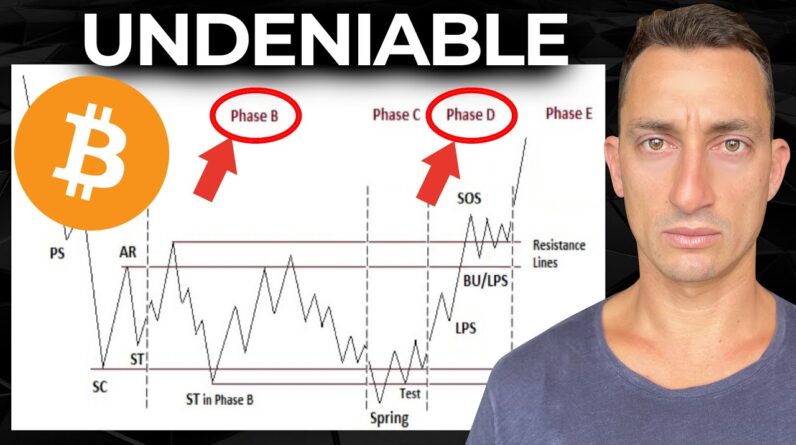

Is it possible that we just saw the Bitcoin low put in yet again three Months after the previous low with many Of the Bears missing out on another Opportunity let's do the massive update For the Wyckoff schematic there is a lot Of disagreement around which phase we Are currently in within the Wyckoff Schematic one is Extreme to the bull Side The Other Extreme to the best side So let's break it down using the precise Tools for this measure I've also got the Four year cycle update and the trans the Trans going from the bear to the bull or Are we in fact not transitioning at all You know to do hit that like And Subscribe button if you want to be up to Date with this series on the Wyckoff Schematic and of course the four year Cycle this is your home of macro cycle Analysis you guys know what to do you See all of the updates here and the Previous one we did for the Wyckoff Schematic was just over two weeks ago as Well so you can follow along with it Here on the channel to see how well We've been tracking the schematic itself And if you want to learn more about Wyckoff and trading investing full-time Link in the top of the video description For our Tia crypto our members are doing Extremely well over there with their Trading and investing and they also get Access to weekly live streams crypto

Trading for cash flow full-on Explanations and courses on that Short-term model portfolio long-term Portfolio along with many other features There all right let's dive into the Wyckoff schematic update taking a brief Look at the short term and then we'll Dive into the Wyckoff and I'm also going To show you a mega mega Target to the Upside and also looking at the stock Markets as well to see if they're also Following some sort of Wyckoff schematic To the upside and a fear and green we'll Get to that in just a moment so the Short term where we left off last week Was basically around here looking for a Close a weekly close above 26k around The 26 one there were more targets to The upside for a longer term hold for The Bulls but at least in the very very Short term we needed to get above 26 000 Because that's our 50 level Plus That level also lines us up relatively Nicely with remaining above these key Support levels so basically where the Market had started to hold a support and Then break down we've now recovered that At least we're above that for the last Few days so the closing price and the Weekly close as well so a quick look at The weekly close shows that we are above 26k and above this shorter term 50 but I Want to take it out to the weekly 50 Which is where we're getting rejected

From right now so that's at this little Peak and that Peak is at 28 400. so you Can see over the last couple of days We've been rejected at that price 26.6 That's the Significant level in the short term that Bitcoin needs to get back above so that It can hold consolidate and then start To work its way higher through this Trading range I don't think it's going To happen super quick but this is also Very nice to see happening quite quickly Over the last three or so days to bounce Out of the 15th June 15th low this was a Time that a lot of bears were saying Everything is wrong everything bullish Is absolutely wrong and we're going to Go back to lower and lower prices now I Don't want to hate on the Bears because This is going to happen exactly the same In Reverse when we get to Peaks it's Going to be the Bulls saying that the Market has to go up further and it's Going to go up further but we're going To see the opposite we're going to see Lower swing tops and then further Collapses to the downside and they'll Just say you just wait you just wait This is a great time to buy the dip buy The dip okay so I don't want to have a Go and polarize different views here but What we're seeing on the chart not my Opinion Union but what's actually going On in the chart is a reversal a bigger

Move than what we've seen previously a Support at least in the short term above These levels here that we want to see it Consolidate to break higher again and if We go to the macro well lower high uh You've got higher lows forming higher Lows forming higher lows forming and we Still have some key areas to the Downside for significant support to Remain in a bullish structure as well so Short term this is the one I'm keeping My eye on here 26 600 and then we'll Start to move the 50 a little higher to Get to those more longer term targets The 27 and a half and ultimately Our Target here twenty eight thousand Dollars for consolidation for a higher Upside so that's the short-term stuff so Far as an update as we get further into Our Wyckoff schematics So speaking of The Wyckoff schematic let's take off Some of these lines here on the chart And then we can start with the schematic To see where we're up to right now the Main thing that we're focusing on in the Last update was the phase which phase Are we in Phase D or phase e several Months ago I had update this and I was Looking at us being in a phase e because We broke out relatively well stayed Above the trading range and we're Looking for consolidation to push higher Now in the one most recently about two Two and a half weeks ago I looked at

This as being potentially wrong fazy and Being in Phase D nonetheless Is still in a bullish picture these are Both Pretty significantly bullish structures To be in Phase D the reason why I was Looking to change it from a phase e to Phase D is that we've had a push to the Upside and it looks like we are going Through this stage here the last point To supply the uh the backup here where The market is basically just trying to Pull as much Supply out of the market Before it before the price can be marked Up again so either way whether it's a Phase D or phase e It's in a bullish State it's in a Bullish structure and if it's in a phase D it's actually got more opportunity now For anyone that missed out anyone missed Out at 15K 18K even 19 and a half K with This low is to be getting into Bitcoin In a re-accumulation error so that's why I'm looking at this as being a bull Market structure a bull market support Before the market goes on further so I'm Not just going to take well hopefully You just don't take my word for it let's Just have a look at the Wyckoff Schematic here itself we've got two Different schematics here in this Particular case we've got schematic one And schematic two but I want to focus on What does phase D and phase e mean phase

D if we're correct in our analysis what Should follow is a consistent dominance Of demand over Supply so consistent Dominance Of demand over Supply so supplier would Push the market down if we had too much Supply and demand is obviously going to Be the thing that drives the market up And we have had a reasonable amount of Supply coming into the market but the Demand has continued to meet the Market's Supply and hold the price up Above key support levels That can still break down maybe it's Wrong maybe we go back into a trading Range and overall maybe this was Actually a phase B because that's pretty Much the difference here many are Looking at this as being a phase B and Others are looking at it being a phase D Or phase e where the Market's basically Broken out my stance is Phase d So the next thing on the the list here Is the evidence this is evidence by a Pattern of advances signs of strength so If we get Advances in the price that's evidence Now of a sign of strength and how we see Those Advances need to be on widening price Spreads We've got a price spread here so from The low to the top then we have another Price spread and I don't think we need

To get a measure out but most of you can See that that is wider than that and now We have another price spread which is Almost equal to we can measure that if We want to get some accurate reading There's about nine thousand dollars or 55 percent To the upside that's eleven and a half Thousand fifty nine percent so widening Yet again okay so I mean it meets the Criteria right here during phase D oh so We go the winding price spreads Increasing volume as well as Reactions so last points of Supply Or on smaller spreads and diminishing Volume all right so there's a lot in There let's just bring the volume up That's basically what is being talked About here so when we look at the The volume That's the upside we want to see Increased volume when the Market's going Up we want to see increased volume when The Market's going up well there's Increased volume compare it compared to What we just previously saw same sort of Deal here now we're getting diminishing Volume on diminishing spreads Diminishing volume diminishing spreads It's exactly what it says right here Diminishing volumes on smaller spreads So during phase D the price will move at Least to the top of the trading range so It says at least to the top maybe this

Was the trading range here I mean that's What I've covered multiple times and We've moved above it and then coming Back to test the top of that others are Calling this the top of the trading Range absolutely May be fine I'm not calling it the top Of the trading range either way we're Still within the rules here so at least To the top of the trading range last Point of Supply in this phase are Generally excellent places to initiate Or add to profitable positions last Point to supply I think it's actually Called last points of support Essentially Supply if there's no more Supply well then we're going to continue Up from that point there's this Increased demand so last point to Support Excellent places to initiate or add two Long positions Not my words this is what is written Down for the Wyckoff schematic here if In fact you believe this is an Accumulation schematic And you believe we're in Phase D others Believe we're in Phase B which means That they are now waiting and waiting And waiting for lower prices which may Never come this may have been the lowest Price 24 700 24 800 depending on which exchange You're on

Okay so if that's the case then these Are the best places to be adding to our Longer term positions because we have a View of this Market going up 50k 70k 100K whatever you think it's Going to take maybe you think it's going To 160 like some of our crazy analysts Over here believe that this Market is Going to go to 165 by June or July that's definitely Not me definitely not my view I think we Still have a lot of time which is why I'm also adding in the four year cycle Update here so I think we've met all of These Conditions we have the phase Deconditions being met which means we Could then move on to phase e eventually Whenever this trading range breaks out What we typically see is a Re-accumulation Zone here so in Phase e The stock leaves the trading range Demand is in full control the markup is Obvious to everyone which is why I think Maybe we're still in Phase D because This markup isn't obvious to everyone we Still have a lot of bears thinking that The market is going to fall I'm sure the Comments will come through it's going to Go below 20K 15K Whatever okay so newer higher level Trading ranges comprise both profit Taking and acquisition of additional Shares or in this case Bitcoin which is

The re-accumulation so this is the main Point to note here higher level trading Ranges that's what TR is so this could In fact be the phase e that's why There's a Discrepancy here between phase deal Phase e which at the end the end of the Day doesn't really matter because we're Both getting in or both believe that It's a bull market And that there's good times to buy in But this would be a higher trading range So you're going to have some sell-offs Because of the profit taking from Traders and investors who bought lower Making 100 maybe they made 70 that's Where the current market sits from the Low to the current price there's your 70.2 percent so some are going to be Taking profits that's a pretty Reasonable move to the upside because Maybe you think the price is going to Chill out here for some time maybe you Get a slightly lower entry that's the Reason for that happening comprising About prop comprising of both profit Taking and acquisition of additional Bitcoin in this case reaccumulation Zone So that's the trading ranges uh they're Sometimes called Stepping Stones on the Way to even higher prices so it looks Like we're still Within These zones here Let me know in the comment section for Whatever reason you think the market is

Still in a phase B And this is going to then come back down And test these lower prices as what Happens in Phase B in Wyckoff schematic One or in in phase two or schematic two Sorry you might get that higher low Interface C of The Wyckoff schematic number two all Right so that's the update of the work Off schematic so far if we start to head Up a little bit higher here well phase e Is probably going to be implemented and We get rejected at whatever the next Resistance level is form another trading Range so on and so forth like what Happened in 2016. a pretty uh pretty Nice ranges here as the market broke out We've got that pump up it re-accumulated And then broke out again that's a clear Example of stepping stones in the market You can even see them happen on shorter Term time frames as it breaks out Re-accumulates again remember this is on A weekly chart so if you're looking at It on a daily you'll be able to see that Even clearer there's just one two three Four five weeks before it broke out you Get another two weeks breaks out it Comes back and tests another two to two And a half weeks breaks out comes back So it just keeps happening over and over And over again to the upside until we Finally Bust from that top action there Speaking of busting now so we've got the

Wyckoff done looking at the four-year Cycle now I want to give you an idea of Where this cycle might end where the Cycle might actually break out of the All-time or previous all-time high into A new all-time high so some pretty big Numbers here to keep in mind Therefore hit that like And subscribe Button don't go anywhere on the channel Uh follow the series because this is Going to help in that longer term view Especially with any of this downside Action that gets really fearful I mean When you zoom out that looks like Absolute nothingness yet you guys know If you were here for the last four days Two weeks whatever This has been this right here has been Absolutely wild a few percent down a few Percent up it's as if the entire show is Over but then you zoom out you go that Is absolutely nothing even if I take it Off log it's still nothing in the grand Scheme of things with with what is Possible to happen if we go to six Figures if we go beyond the six figures Like it's just it's going to be Absolutely nothing okay so getting back To the time frames here well we've got a Thousand or so days to the upside Basically I'm looking at a thousand to Twelve hundred days from the cycle low To the all-time high it happened yet Again on the previous cycle

So we've got this one here There's your Thousand Eleven Hundred Days from the cycle low to the peak and Again this is where the market was Looking to low this is new data that's Come in but this is typically where we Measure the cycle low from so 1100 days Nonetheless even if this was incorrect And it was longer in that case either Way the move to the downside also works Out in a pretty good fashion basically The timing is dead on there 410 days for 11 days 363 so basically another year And again 376. so if we were to go to the most Extreme which is 410 That would take BTC out so the low would Have happened Around there so basically the end of December the early part of January so We're set well we're now six months away From that point so if we were to go to a New low this would be the lowest or the Longest bear Market that bitcoin's ever Faced and of course some of those Reasons would be well we're in a looming Recession markets are going to collapse Further there's a lot of things going Wrong in the economy and don't get me Wrong there's a lot of stuff that Doesn't make sense logically the market Should be collapsing when you think About all of the the wrongness and all Of the the bad that's going on and the

Things that just don't make sense when It comes to the uh the economy but we Have to remember we're not trading the Economy we are trading the markets we're Trading the data we're Trading a little Ups and downs on the chart and the ups And downs are telling us this is an Uptrend so if we want to deny that That's a different style of losing money But if we want to go along with it then Well we'll be making money because the Market is going up so keep in mind what Your time frame is and what it is that You're actually Trading So Fourier cycle still seems Rel well Still it's definitely on track at this Stage there's been no breakdowns and the Market isn't doing anything different to What it's done in the past so that's What we're looking for we're just Looking for lows to lows so the overall Time frame here from the low to the low That 1400 days and we can Market back to The previous one also about 1400 days And of course this one here is going to Be slightly longer about 15 or 1600 days There you go 15. so if we have that in Mind and we know that the market goes From the low to the top roughly a Thousand days if in fact this is a Strong bull so there are a couple of Disclaimers because this could go to a New hire quicker than the Thousand but That is going to be a weak Market

Structure and if you don't understand That just think about when a market Rises very very quickly It typically has to come down for a lot Longer because if it goes up fast it Needs some time to chill out get some Support build the Stepping Stones before It can move again and if it is unable to Build those Stepping Stones it will Break down that's just as simple as it Is in this case We've ran up really Quick built one stepping stone or very Big stepping stone and we'd attempt it Again the beauty is that it fell right Within the four-year Cycle Theory here But around the Thousand Days to the Upside and then tried another stepping Stone to go on longer but it just didn't Have the time left in it the bull market Was over and you can see that it Collapsed from that point so that's why We're looking at this as being a refresh Which means we need to have a look at The time frames here You can see it there a thousand days Where does that take us well to the next Peak roughly the second half of 2025 so Still on track for a top in the market Not a new all-time high but a top in This cycle roughly the second half That's a six month window here of 2025. What about for a new all-time high price This is probably the exciting part well It's taken about a thousand days from

The top In the previous cycle to then touch a New all-time high so that was about a Thousand days Eleven Hundred Days in the Cycle prior to that The top to a new test of an all-time High roughly around 1100 days if you Want to take it to this March period in 2017 the fear at this point where the Market dropped from there was basically China Banning Bitcoin I'm sure you've Heard that before but that was what the Fear was at that time that's basically When I got into the market uh it's about 1200 days so we can look at anything From about a thousand to twelve hundred Days For Bitcoin to reach a new all-time high I'm not saying that's the top of the Cycle so keep that very clear not the Top but a new all-time high In fact it may be a top I should add That but what all I'm saying here is That is the time frame to a potential New all-time high And if that is the top of the market so Be it that's what it is there but I Think we possibly have a little further To go from that point and if we look at Our thousand days from the all-time high Stretch this out this is going to take Us to approximately August of 2024. so We can say The second half of 2024 could

Potentially get us to a new all-time High if it happens earlier we'll track It no worries we've got the data there That we can start to identify whether It's going to happen sooner nonetheless We're trying to figure this out a long Way from the actual point it's over one Year from today being in June And so if we look at that as a gauge Second half if it's August 2024 what is That third quarter of 2024 okay so That's one key area to keep in mind From the bottom to the all-time high now Roughly speaking Second half of 2025. so there's going to Be that window when the market breaks Above the all-time high maybe it goes For about 12 months no one honestly Knows we just got some rough gauges here In terms of time frames so that's all I Want to keep in mind here as we sift Through the Wyckoff schematic update the Four-year cycle update as well of course There's gonna be plenty more on the Channel Make sure you do subscribe and If you want to learn more about the Wycloff schematic go check out the Investor accelerator this one is a very Succinct course to teach you how to use It in your trading as well so that link Is in the top of the video description Exclusive to Tia premium all right so Let's have a quick look at the Wyckoff Schematic with the stock markets before

I go to these ballistic Huge targets Of 228 000 and then a quick look at the Fair and green index as well so we have An understanding of the schematic we Have tests we have selling climaxes we Have last points of supply and then we Have the breakout of the trading range So this is what I previously had on the Chart for the S P 500 you guys might Remember seeing this transitional period And then through this period and this Period I was cautiously confident of the Bull market going to break out to New York time highs so cautiously confident I mean talking amongst myself my brother My friends I was confident that this is Not going lower but Publicly I'll say cautiously confident Because I don't want to piss the Bears Off too much because maybe some of them Will Start to learn something within that Period And they might get into the market as It's going up as well maybe they'll flip Earlier but if I Give you that polarization that Obviously pushes a lot of people away And I don't want people to miss out on The runs that are potentially happening So hopefully that makes sense when it Comes to the psychology uh especially When you don't agree with someone's

Message and so far this thing has gone Absolutely nuts so I'll get rid of that Now transitional period that's what We're calling this here going from our June low to October low December low March low and then we even had these Little April and May Lowes the market is Absolutely blasted through so we're out Of the transitional period maybe we come Back and test some of these higher Prices maybe we just hold out at these Even higher prices to consolidate Because this Market has been going up Very strong for the last several weeks No I don't think we'll get a new low no I don't think these lows will come back And get broken out or broken down now 3 800 points but anything above that take Your guess for this point in time so Transitional period we're out of that We've gone from a bear to a bull Technically speaking You can keep calling it a bear if you'd Like that's your call nonetheless we're Now at the rejection trap here and Looking at the work off schematic well It looks like we've put in our Low Our test we started to accumulate at Higher prices we've got this little bit Of a phase D type structure happening Here at the top of the trading range Right there and now we've broken out Potentially into a phase e how does it

Look on the NASDAQ so everything that I Just said there applies to the NASDAQ as Well talking about these lows holding in We basically got the tests The bottom the next test the higher low We've got the banking crisis low higher Low we've got the move to the upside Potentially this phase D pattern forming At the top of the trading range here and What do you know phasee Lowe's the Market away closing above resistance we Want another couple of weeks closes up That above those price ranges for now But overall this is well and truly into A bull market that is just an uptrend i Can't argue it any other way because the Chart is saying it's a bull market the Economy things still seem pretty rough And they will continue to seem pretty Rough especially as we move up in the Prices here but if I'm trying to go long In a market and buy stocks low and sell Them high lows are always formed on Pessimism and you know yourself we had a Lot of pessimism in stocks so crypto Bitcoin you name it there was pessimism Every single day throughout that low That's just a typical sign of a bottom So NASDAQ also looks like it's followed This same pattern as well out of that Bottom into phase e Nonetheless we'll continue to follow up So these crazy targets here For Bitcoin although I'm bullish I don't

Want to get swept up into the Ridiculous moon boy bull case because Eventually we're gonna have to flip Because we'll get some tops but Just looking at some of these patterns Here uh nothing against any of these Patterns it's just the targets which are Absolutely wild in terms of the time Frames okay just the time frame so 160 200 I don't care but it's really just a Bit of a I think warning in case you Start to get swept up into a time frame Of June July this year which is only a Few weeks away for this Market to get up To 100K 165k 200k overall I hope many of You have got your positions in the Market but Don't get too swept up like this Remember what happened in the previous Cycle and the cycle before that and the Cycle before that and before that it's The same thing you know we get to these Tops and everyone starts calling 100K we Get to these tops in at 20K everyone's Calling for 50k it's it's just a wild Place to be because I mean that's what Happens in Bull markets it's just a wild Place that's why I started earlier on be Careful of the narratives that get Thrown out there and that's precisely What I put together in a tweet so links Are in the video description for my Twitter and Instagram this is a very Long tweet but it just gives you the uh

Understanding of what we'll probably see Next and I think if you can prepare for What we'll see next in the media and High profile analysts that you see on I Don't know Twitter or YouTube or Whatever and if you can prepare for how They'll start to talk you will be miles Ahead of everyone else because this is What I've noticed over 15 years of my Own trading and investing everyone seems To take the same sort of approach and You wonder why ninety percent of people Lose money okay so go and read this this Is just talking about six ways high Profile analysts and financial media Will begin to Pivot on their bearish Views I'll give you one or two for now They'll simply begin talking about the Bull market more than the bear market And basically they know that many Investors don't remember history and Like you know yourself people that were Here in 2021 are probably left those who Bought the top and they'll come back Later so they won't know what people Have talked about for the last two years And they'll come back and see what's Going on two years later so they'll Simply forget that they were bearish at The bottom because most people just Don't stick around and they'll come back At the good times only there's a few Other ones there something just to set Aside and go through in your own time

Because there's a that would be Extremely helpful that's all I'm going To say there otherwise I'll keep Rambling because I still want to get Onto the crypto fear agreed index So this looks like we are still on the Reset path this is obviously what we've Been following for many months now we Were getting a little bit greedy here Hitting the 70 Mark and of course when You hit 70 Probably it's getting time for a bit of A pullback we have been further in the Past just for a brief period like in 2019 when we went on that run from 3 000 To 14 000 but that was a extreme case Right nonetheless we have now hit 70 We're hovering around 60 and 70 for a Little bit and we've now broken down my Target was to hit 40 for the end of the Reset and it looks like we will have to Settle with 41. so if I throw get this a Little bit closer we got to 41 on the 15th which in fact Marked the low so there's your 15th bar Here 14th was a massive scare 15th and Now we've pushed away from that point Let's see I never want to say that Everything is over especially in the Short term but in terms of the macro That's where I'm far far more confident The short term nonetheless we are Holding up here we've had a nice move Away from that low beautiful two months

Down beautiful mid-month Turning Point Yet again this was the 14th this was the 12th this was the 15th the market is Turning nicely on those 30-day moves Fear and greed looks like it's resetting Now hitting that 40 area and what we Could hope for the best thing we can Hope for is that this does not get too Greedy we don't want it to get into the Greed we want it to stay neutral or even Just hover around here and start to just Drop into that fear give us just a touch Of fear underneath the 40 level and that Would be a nice reset for the crypto Fear and greed otherwise I don't think It's absolutely necessary this is also Looking relatively good if we just track A trend line well maybe if we get a Breakthrough and just hold above these Levels that's going to be a pretty good Area for Bitcoin to continue to Consolidate with because remember we Watch that uptrend work from the June Low and then there was November at a Higher low so we knew that the fear was Leading the market even though the price Was a lower price great times to be here In the market all looking relatively Good for the next stage that is your Update if you want any other details Links are in the video description also The Wyckoff course is down there as well Like And subscribe guys I'll be back With a another video for you hope you

Had a fantastic weekend And I'll see you in the next one until Then peace out