🏆 Free Crypto & Economic Report Out Now!

📈 TIA Gann Swing Indicator

🔐 Crypto Storage LEDGER

Subscribe to Michael’s Channel

Altcoins have pumped over the last 7 days. In this video, we look at several reasons why we could see further upside but still remain conservative in our investing.

Prepare for the year ahead in Bitcoin and Crypto by watching these chart signals.

UP TO $38,755 FREE! Crypto Exchanges

🥇 ByBit Free $30,030 + 0% Maker Fees (NO-KYC)

🥈 Bitget Free $8,725 (US + Global Users NO-KYC)

🇦🇺 Swyftx, Best Australian Crypto Exchange

▶ My Official Socials ◀

YouTube

Instagram

Twitter

▶ My Must-Have Crypto Resources ◀

Education – TIA PREMIUM MEMBERS, Trading Courses & Exclusive Community

Charting – TRADINGVIEW ($30 Off)

Storage – LEDGER

Tax – KOINLY (20% Off)

Trading – TIA GANN SWING INDICATOR

This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. #crypto #bitcoin #cryptonews

With Bitcoin up around four percent over The last seven days and all coins doing Many multiples of that it seems like the D-gens are back in the crypto space so Although there is a lot of bullishness Hyping up the markets right now I want To put that into perspective but not Take away from the bullish fun times That are potentially ahead for 2023. We're going to look at the short term in The long term for Bitcoin but then also Extended over bigger Cycles looking at The presidential cycle looking at the Returns for January and of course what We could expect for the quarters ahead Make sure you've liked and subscribed to The channel I hope you're having a great Day out there and that you're ready to Dive into another macro analysis video For Bitcoin and of course the macro Markets out there this is your home of The Cycles all right guys let's first Dive into Bitcoin looking at some of the Key resistance levels the pivot Points Here on the Bitcoin chart and then take A look at what sort of returns uh Bitcoin has seen throughout this year And why we're expecting it to be a Hopium filled year although there are Going to be particular rejection points And more turbulent times ahead at least For the first half of 2023 in the case Of BTC but we may see some better upside For the s p so this is building upon the

Previous videos we've got on the channel Especially from last week looking at 2023 predictions which I'll leave a link To at the end of this video enough said About that let's dive into these Particular points here on BTC so like I've got here just over the last seven Days we're up about 3.8 percent Everyone's Gone Bananas that's because We haven't really seen much happen on This chart since November so basically Two months now and we've been tracking Between 15K and roughly 18K but more or Less 17 17 and a half There's a major level here at about 18 And a half thousand dollars so the Reason I bring this up is that although We can see some good bullishness these Are going to be particular key levels That we need to see Bitcoin flip of Course there's some shorter term numbers There's always going to be resistance Especially after such big breakdowns From the upside to the downside What I've got here is the Tia Gantt Swing indicator there's a link to this In the top of the video description it Gives key pivot Points on the charts Especially when you're looking at macro Swings in the case here of the weekly or Also if you want to jump up a time frame To the monthly chart here so the key Level at the moment is around 18 and a Half K you can see the bottoms were

Coming in during June July September October we crashed through it in November got rejected in December and Here we are in January so this is Basically splitting the main swing in Half that's at around that 18 and a half K level and of course it was support and Resistance so far yesterday's video we Looked at other key levels to the upside Around 21.5 K is another monthly swing Top that was the top there in November And then the other key level is twenty Five thousand two hundred there's going To be a lot of key levels because the Market has basically been reducing in Volatility and the price ranges have Been reducing as well so first things First a 18 and a half K that's a key Level that we're now looking for this is Going to be dynamic depending on where That next low comes in if November low Stays at 15 400 then this is the price That Bitcoin needs to overcome like we Saw on the weekly the swings are still Down so lower tops lower bottoms just Putting in a higher low here but it Essentially turns it from a down to a Slight uncertain because we don't have a Higher top yet either so that's BTC on The weekly and the monthly looking at That key resistance level to the upside So we need to take that into account When we start to look at some of the Other returns moving forward for January

And this first quarter of 2023 something That can help BTC potentially overcome This level is the US dollar continuing To collapse you guys can let me know in The comments section how many times We've talked about not reading into the News and when everyone else is talking About how bullish markets are we did This in September basically to a T at The top of course things can always be Wrong so I'm not going to be too Outspoken about it trying to remain Humble about getting those tops but Essentially it's when the news media Goes absolutely ballistic like I did in September 2022 top comes in the US Dollar down she comes we still have Barely seen a bounce on the USD meaning Weakness in the US dollar which like We've seen in the past tends to coincide Roughly with a little bit more upside to Some of the riskier assets like Bitcoin So we did see a little bounce in the First week of January coming up to Around 105 and a half but this week We've just broken through the lows at 103.4 and we've tested around just the Top end of 102. so if this continues to Break down this weakness on the USD Could give a little bit more strength to Bitcoin or at least take the pressure Off Bitcoin and people start to Gam Symbol their money again the usds into The Bitcoin price which is potentially

Why we're seeing a little bit of upside On bitcoin as well at the moment so Continuing to follow up on the US dollar Chart as well Turning our attention to the January Returns so we've covered the US dollar Why things could potentially continue to Go up in the short term we'll look at Some more longer term stuff as well Looking at Major Cycles this year or so You know in quarter one but in terms of January returns this is part of what We're looking at with the the January or The 2023 Bitcoin prediction in last Week's video as I said I'll leave a link To those at the end of this video make Sure you like And subscribe so you don't Miss a miss a video here And so far uh what we have noted is that Unless it's a bear Market year like it Was in 2014 or it was in 2022 the Closing price from January to the next 12 months January the next closing price Has been up every single 12 months from That time so essentially this pink Vertical line is the January date you Can see 2011 there's the close to the Next close of January 2012 up 900 of Course we're not expecting another 900 Return that's just ludicrous from the Current price of seventeen thousand Dollars you know we're not expecting Anything to get close to 150k in 12 Months it would be lovely but it doesn't

Seem like it's going to be very likely Just looking out from the bear Market Year something that could be a little More likely going from the close to the Next 12 months close approximately 70 Odd percent so that's from the bottom in 2015 to 2016. and so if we look at this As being a four-year cycle year Especially with the halving coming up in 2024 this is probably a little bit more Realistic to what we could expect for 2023 so 2015 was also the year before The halving harving was in 2016 and then we also had a Harvard year In 2020 which was essentially this year Here so 2019 January close to 2020 January close you can see the close Here to the next close it was up about 170 percent so different numbers there 70 and 170 but either way they were both Up years following the bear Market year And every other year from that has also Been up even so slightly from 2021 to uh 2022 where the bear Market really did Start to kick in it was still up about 16 so that's a pretty positive result Looking forward 12 months but I hear you At the other end bitcoin's never been Through a recession recession's coming For the US it's coming for the UK it's Coming for all the big countries around The world but I ask you to stop and just Reflect on the charts looking at the Major indices around the world the UK

2.2 from an all-time high that does not Sound like deep dark depression or Recession times ahead sure the market Could drop into recession but we haven't Got there yet maybe just maybe we don't Get there we don't know yet so I'll Leave that aside because essentially no One knows yet if we are getting there of Course the technical explanation or Definition of a recession is two Negative quarters we got that in the U.S So call it what it is however you see Fit the uh the Dow Jones less than 10 in The Aussie Market less than seven Percent away from all time highs so take A look at that before we get too deep Into those recessions and especially This year 2023 is a presidential election year Well the third year in the presidential Cycle next year is the presidential Election year in 2024 the third year of The cycle Biden's been in for three years every Single uh cycle counting back to 1933 And in some cases also 1896 so over a hundred years of data Here that third year has been extremely Bullish for the markets in this case the The Dow Jones because that is where the Majority of the data is from so the Dow Jones is 30 biggest stocks in the U.S of Course the s p is the 500. so the third Year that first quarter is quite bullish

Five percent up the second quarter three Percent up and then the third quarter Just point four with the final quarter Of the year which is this particular Year this is a third year of the Presidential cycle just being up 1.4 Percent the election year does still Have some good returns but it is a Little bit more choppy in that first Half of the year and like we saw last Year which was 2022 that second year of The election which is also a midterm Election year you can see that those First three quarters uh basically Negative or pretty much no growth Whatsoever this is over 120 years of Data I hope you take that away and look At that for what it is that was expected In 2022 then that final quarter four Percent up finally got that bit of a Rebound so looking ahead for 2023 we're Still looking at reasonably Good Times Ahead there's there's good reasons to be Bullish but like I said earlier in the Video just looking at those key Resistance levels for Bitcoin is going To give us a big heads up as to whether We're going to get that flip or maybe Remain a little bit more subdued for That quarter one and quarter two for uh The first half of 2023. the other piece To have a look at is the Bitcoin halving The halving's about 443 days away that's Going to bring us into April May March

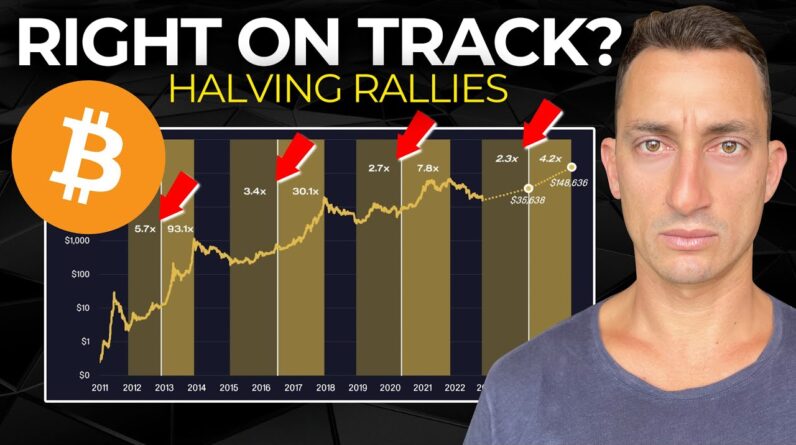

Of 2024 this is always changing of Course so sometime around that late Quarter one or quarter two of 2024. what We've seen in the past is the pre-hub Rally The white line here is the halving and Then the the Golder side is the post Halving rally so the last cycle which we Saw from 2019 to the peak there in 2021 You've got the PO the pre-harving rally Was 2.7 times from that Bitcoin bottom Price leading up to the halving then we Had a 7.8 x return from the halving to The peak so if this is roughly the low Here at around that 15 or so K the 2.3 Times return because these numbers Continue to drop Each cycle looking at 2.3 times could Potentially get us to around that 35k in 2024. now I don't want to pin that Number down whatsoever I'm just looking At it in terms of the market probably Being up from the low whether it's Quarter four in 2022 or or quarter one In 2023 but probably being up coin price Leading into that halving date sometime In 2024. we'll look at this further Throughout the year so make sure you do Subscribe to the channel like the Content reminding you in case you're Finding some value throughout the video Speaking of which we need to look at the Value here in terms of the Bitcoin Quarterly returns 2022 saw four red

Quarters the first time it's ever Happened but we can look at quarter one It's basically one percent down and Quarter three was two percent down sure You could call it four red quarters but Those two were were pretty uh very very Small numbers here the same sort of deal Goes for the other years you've got 2018 So instead of it being a slight negative Of two percent it was a slight positive Of 3.6 percent the only real year that It was uh pretty Mega in terms of a Quarter growth or a green quarter in a Bear Market was 2014. so three pretty Significant uh quarters down but then One significant quarter up 40 which was In Quarter Two nonetheless the bear Market years of 2014 uh 2018 and 2022 Generally resulted in a reasonably Otay year the following year so looking At 2019 we saw uh nine percent in the First quarter and about 160 in that Second quarter that was that big pump up That we saw on bitcoin but of course Those gains were then later lost in Quarter three and quarter four and so I Want to talk about there's the Possibility of being quite hopeful and Bullish for 2023 it's probably unlikely That it's going to be that year that Shoots to new all-time highs so it still Pays to be cautious throughout 2023 and Not getting sucked into those fomo pumps Thinking that the bull market could come

Earlier than anticipated of course we Don't have the crystal ball but looking At cycles and especially after Big Bear Market years it's not very likely that We shoot to new all-time highs or pump Up extremely hard and then not revisit Those lower prices of course 2019 did Have that pump that's what it Experienced there that 340 growth on Bitcoin but then it was later given back All the way into December so essentially It was a 12 months of hype and dump with A little bit of opium again in that Early part of 2020 pandemic dump and Then the market took off for that bull Market so if we didn't have the pandemic Maybe we did hold out above those prices But a lot of those gains were given back During that second half of 2019. so there's still that extra Opportunity to wait for that Confirmation they can get in a little Bit earlier in the confirmation or not Get sucked into the fomo and actually Save money instead of getting hyped up Into those Peaks if you miss out on that Particular run so I've looked at Bitcoin Historical Returns on the quarterlys We've looked at Bitcoin on the monthlies And yearlies going from year to year We've looked at Key resistance levels Ahead for Bitcoin in the short term Trying to piece all all of these pieces Of the puzzle together for the longer

Term outlook on bitcoin why we can still Be bullish but remain cautious as well Now let's take a step back to the Broader macro picture here which ties in To the harvesting event as well this is A look at bitcoin's annual returns or at Least just the annual candles for the BTC chart so the Tweet thanks to Rector Capital you can see candle one is the Bitcoin reaching its bull market Peak so It's basically the year after the Bitcoin halving so that halving is 2012 2016 2020 and of course going to be 2024. so looking at looking ahead we Still have another couple of years until That point like we said about 1.3 years Until that halving so a year and a year And a third candle two is basically the Bear market we've seen that each time Candle 3 Bitcoin bottoms out that could Be this year or could potentially been The end of 2022 You know we bottomed out pretty close There in November but maybe we see it in Quarter one which then gives us candle Four which is the BTC recovers and Begins the new trend which then leads Into candle one again where we see that Peak and so if this is to occur again And we get that same sort of cycle which Has happened uh multiple times already Candle three this is basically where we Start to bottom out sure we could dump a Little bit lower than that 15 400 or so

Low but in terms of where we currently Sit throughout the cycle this Essentially marks the bottom and what We've been talking about being that we Could see that whole bottoming process Happen throughout 2023 so mix this in With the hardening and also the Presidential election cycle being that This is the third year where the s p Usually sees the biggest gains and of Course people have got some more money To throw around even if those money Printers are turned off you can still See governments put out more and more Money to different programs like we saw Recently with the Biden program of 1.7 Trillion Maybe blows out to two trillion Dollars money doesn't just have to come From turning on money printers in the Way of quantity of easing they can Basically come up with some other Programs that are there to stimulate the Economy and of course that flows more Money into the markets you can also have More money flowing into the markets from Banks creating credits the same thing More money enters the system and it does Not have to be from the FED turning on The money printers they essentially Allow the banks to create more credit And that money gets handed out to people For speculating on cryptos or real Estate or businesses or Tech or whatever It might be so there's a number of ways

That money can come into the system and Like we see with this cycle here that's Been going for over 120 years This is one of those years that we could See some big moves in the stock market Which could also lead into Bitcoin but Let's not get too ahead of ourselves we Don't have those macro confirmations Just yet still we can still be bullish And filled with opium but just remain Cautious because we're not out of the The doldrums just yet Now cover all of This macroeconomics in a lot more detail With our investor accelerator members Link to that is in the top of the video Description otherwise stick around for The free content on the channel That is Popping up on your left hand side here All the previous videos as well Bitcoin Cryptos real estate macro economic cycle And of course follow us on Twitter and Instagram for more timely updates thanks Once again guys I'll see you at the next Video Until Then peace out